Worried about a looming recession? Here’s how to financially prepare, according to experts

Contrary to popular belief, you don’t have to give up your daily latte to be "recession-ready."

Despite high inflation and rising interest rates, the United States has avoided a recession for several years. Lately, however, new tariffs from the White House have reignited recession concerns. Consumer confidence is falling, investors are on edge, and markets are rattling. These signals point to potential economic challenges in 2025.

While uncertainty lies ahead, taking proactive steps now puts you in control of your financial future. I spoke with professionals across banking, wealth management, and consumer finance sectors who shared practical strategies beyond the tired 'cut coffee' advice. Their recommendations below target high-impact expense categories while preserving quality of life during challenging times.

6 ways to create financial security before a recession hits

“In stable economic times, consumers [should] save around three months of living expenses,” advises Andrea Woroch, a consumer finance and budgeting expert. But “when economic uncertainties grow, it’s good to increase this amount to six months or more.”

Beyond emergency savings, these moves can create financial security as a recession looms:

1. Secure your savings in stable, interest-bearing accounts

Unlike volatile investments that fluctuate during economic downturns, deposit accounts give guaranteed returns with minimal risk.

“Put as much money as you can now into a Certificate of Deposit (CD) [or] money market account,” advises Derik Farrar, head of personal deposits at U.S. Bank. This strategic move serves two purposes. First, it takes advantage of current interest rates before potential reductions. Second, it secures your money in FDIC-insured vehicles.

Pro tip: Consider using a CD ladder strategy with varying maturity dates. A CD works by dividing your savings across multiple CDs with staggered maturity dates (e.g., three, six, 12 months). As each CD matures, you can withdraw funds or reinvest them into new CDs. This approach balances liquidity while earning higher interest rates than regular savings accounts.

2. Review and adjust your energy usage

“If you’re charged a higher rate during peak hours, do chores [such as] running your laundry machine and dishwasher during the morning or late night to reduce energy costs,” Woroch suggests.

Besides timing your appliance use, unplugging electronics when not in use eliminates “phantom power” drain. This simple habit can slash your energy bill by up to 10%, according to the U.S. Department of Energy.

Pro tip: Invest in smart power strips that cut power to devices in standby mode, or programmable thermostats that optimize heating and cooling schedules around your daily routine. These upfront investments often pay for themselves within months while delivering long-term savings.

3. “Pause and resume” subscriptions

Review.org’s 2024 State of Consumer Media Spending Report found that Americans spend over $3,200 annually on internet, mobile, and TV streaming services. This makes subscriptions one of the easiest areas to trim expenses without drastically changing your lifestyle.

Here are examples of subscriptions worth re-evaluating based on your usage:

Streaming services: If you're paying for Netflix, Hulu, Disney+, and HBO Max, consider rotating through them based on what you want to watch. Keep one active for a month, then switch to another.

Fitness memberships: Track your gym visits for a month. If you're paying $50 or more monthly but only visiting a couple of times, consider switching to pay-per-visit options or free home workouts until your finances improve.

Food delivery subscriptions: Services such as DoorDash DashPass charge monthly fees that only make financial sense if you order frequently enough to offset them.

Music services: If you rarely use premium features on Spotify or Apple Music, it may be worth downgrading to free, ad-supported versions.

Shopping memberships: Amazon Prime or Costco memberships are only worth keeping if you're using their benefits to save more than they cost.

Pro tip: Farrar recommends calling your service providers and asking for ways to reduce your monthly bill. “They may offer customer loyalty discounts or other ways to save,” he points out. For instance, SiriusXM often has unadvertised deals on its plans. You just have to pick up the phone and ask for them.

4. Stack your income through side hustles

Additional income streams provide financial protection when a recession threatens your primary job. Hanna Horvath, a certified financial planner, money psychology expert, and creator of Your Brain on Money, encourages leveraging skills and assets you already have. “I’ve chatted with people who’ve monetized [what they know] with low startup costs,” she says.

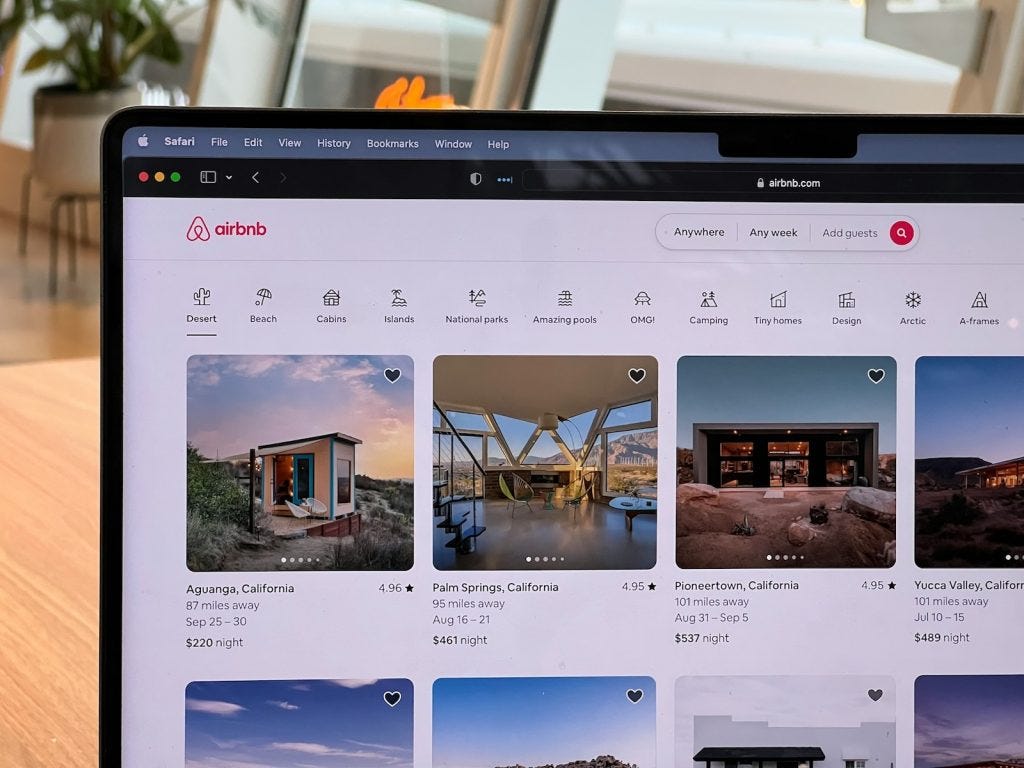

Woroch proposes renting underutilized assets rather than working more hours. For example, “you can make money renting a spare room on Airbnb, your car when not in use via GetAround, or even unused baby gear through BabyQuip,” she explains.

Here are more recession-resistant income ideas you could try:

Tutoring: Education remains a non-negotiable priority for most families. Parents usually cut other expenses before sacrificing their children’s academic support.

Digital products: Create once, and sell repeatedly with minimal ongoing costs. A well-designed digital planner or template collection can generate thousands in passive income. You can sell these on platforms such as Etsy or your website.

Home maintenance: Focused repair skills become more valuable when replacement isn’t tenable. Specialized knowledge (e.g., appliance repair, HVAC maintenance) commands premium rates because it saves homeowners from much larger expenses.

Selling unused items: Recessions increase demand for second-hand goods. Use eBay, Facebook Marketplace, or Poshmark to turn forgotten items in your home into cash with minimal effort.

5. Revisit your 401(k) and adjust your allocation

“If your highest concern is protecting against further declines in your 401(k), adjust your allocation toward short-term investments that include Treasuries and money market investments,” advises David Freisner, CEO at Konza Global Wealth Group, a forward-thinking wealth management firm. But if you have moderate concerns, you might include corporate bonds and high-yield funds to balance protection with potential growth.

Don’t try to time the market by moving everything to cash, however. “[Doing this] can lead to missing out on positive returns when the markets recover,” he warns.

Instead, keep your investments diversified. If you can, continue making regular contributions. Buying more shares at lower prices can position you for higher profits when market conditions improve.

Note: While these general principles apply broadly, your retirement allocations should match your age, risk tolerance, and money goals. Consult a trusted financial advisor for tax-smart options that fit your timeline. Their advice is invaluable during market swings, when emotions might affect your choices.

6. Get serious about meal planning

Dining out eats away at your finances faster than cooking at home.

The latest U.S. Department of Agriculture (USDA) data shows restaurant meal prices increased 4.1% in 2024. This is more than three times the 1.2% rise in grocery prices. When you add transportation costs, fancy beverages, and tips, you’re often paying $15 or more for a restaurant meal. In contrast, home cooking averages $4 to $6 per meal.

“Start meal planning to reduce food waste and save on groceries,” advises Woroch. A weekend meal planning session ensures you have food ready when you need it. This makes you less likely to order expensive takeout when you’re tired or busy.

Expense categories to target while growing your savings

Contrary to popular belief, you don’t have to give up your daily latte to be recession-ready.

The biggest impact often comes from adjusting these expense categories:

Mobile data plans: “72% of consumers with unlimited data plans only use 15 GB of data each month,” Woroch points out. Review your actual usage and switch to a lower-tiered plan or budget carrier to save money without changing your lifestyle.

Insurance: Shop around for better rates without sacrificing necessary coverage. Ask about bundling home and auto insurance, and adjust your deductibles based on your emergency fund strength. “I normally advise consumers to increase their deductibles to enjoy savings on monthly premiums,” says Woroch. “But right now, a lower premium can cushion your budget in an emergency.”

Transportation: Vehicle expenses often consume 15% to 30% of household budgets, according to the United States Department of Transportation. Could you downsize your car? If you have an auto loan, have you looked into refinancing? Would alternative transportation reduce your monthly expenses?

Housing: Getting a roommate or moving to a less expensive location can help you save money as a renter. If you’re a homeowner, renting a spare room brings in extra income during tough times.

Debt: Call medical providers to negotiate payment plans, explore student loan deferment options, and understand mortgage forbearance (though Woroch emphasizes this should be a last resort).

The bottom line

Preparing for a recession means making choices that reflect your priorities — not following arbitrary rules. Financial discipline becomes easier to maintain when you align spending with personal values.

Not sure where to begin? Start by tracking where your money goes. Woroch recommends a zero-based budgeting approach that “assigns a job to each dollar,” whether for debt payments, savings, or necessities. Tools such as the You Need a Budget (YNAB) app can simplify this process.

Enjoying Wavecomber and want to support my work? You’d make my day with a Pink Drink.

Note: This story was originally published on https://wavecomber.com/how-to-prepare-for-a-looming-recession/.

Sources:

1. Federal Deposit Insurance Corporation (FDIC), “Deposit Insurance FAQs.” Accessed 9 Apr 2025.

2. J.P. Morgan, “The probability of a recession now stands at 40%.” Accessed 9 Apr 2025.

3. Navy Federal Credit Union, “Yes, You Should Still Contribute to Retirement in a Recession.” Accessed 9 Apr 2025.

4. Reviews.org, “State of Consumer Media Spending in 2024: Cost of Internet, TV, and Mobile.” Accessed 9 Apr 2025.

5. Space Coast Credit Union, “How CD Laddering Works and Benefits of this Savings Strategy.” Accessed 9 Apr 2025.

6. The Conference Board, “U.S. Consumer Confidence.” Accessed 9 Apr 2025.

7. U.S. Department of Agriculture (USDA), “Food Price Outlook - Summary Findings.” Accessed 9 Apr 2025.

8. U.S. Department of Agriculture (USDA), “U.S. food-at-home prices increased 1.2 percent in 2024 compared with 2023.” Accessed 9 Apr 2025.

9. U.S. Department of Energy, “3 Easy Tips to Reduce Your Standby Power Loads.” Accessed 9 Apr 2025.

10. U.S. Department of Transportation, “The Household Cost of Transportation: Is it Affordable?” Accessed 9 Apr 2025.

These are some great tips, especially evaluating subscriptions. It's easy to forget what subscriptions you have and they can add up quickly!

I really appreciate the diversity of strategies you suggested here. Many are very practical and simple - totally do-able.